For those looking to move from South Africa, a burning question often remains: what happens to their hard-earned retirement funds? How, and when, will they be able to withdraw their retirement interests in South Africa; and of course, where will these be taxed?

With our recent trip to the Isle of Man, it has been clear that that there is still a lot of puzzlement among South African expatriates when it comes to this issue. With recent changes to legislation, understanding the nuances of withdrawing these funds has become crucial. Here’s what expats should know.

The three-year lock up rule

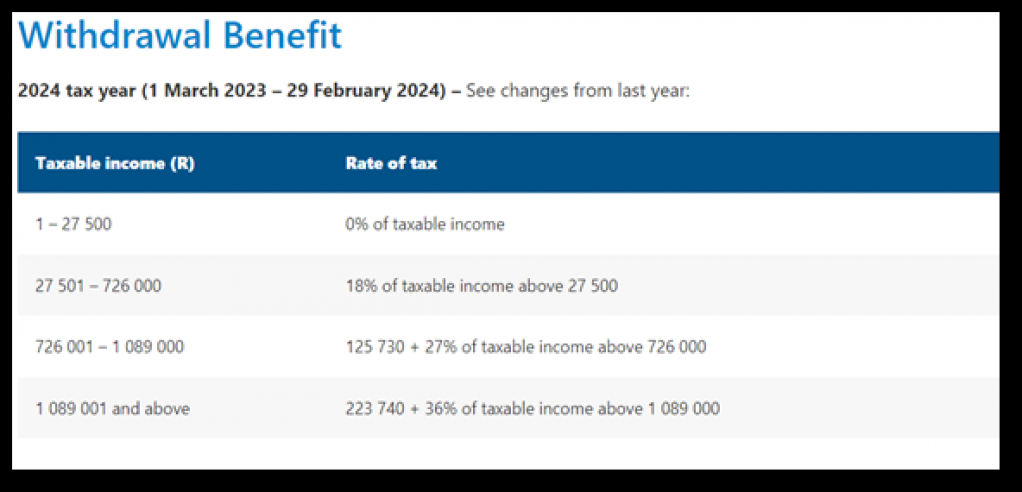

Previously, individuals leaving South Africa could withdraw their retirement funds immediately after confirming their emigration status with the South African Reserve Bank (SARB) and South African Revenue Service (SARS). However, since March 2021, a new rule mandate a minimum three-year lock-up period before these funds can be accessed in full. The application of the lump sum withdrawal table becomes pertinent in such cases.

Proof of tax non-resident status

Navigating the withdrawal process involves understanding the procedural requirements and specific nuances associated with it. An essential step includes providing proof of tax non-resident status, which is generally in the form of a Notice of Non-Resident Tax Status issued by SARS. This Notice confirms the individual’s date of tax residency cessation and is considered to be crucial evidence required to process the withdrawal by the relevant policy holder.

Without this Notice, these retirement funds will often remain locked in South Africa.

The two-pot retirement system – a potential hurdle

The anticipated introduction of the two-pot retirement system in March 2024 could pose further challenges for expatriates seeking to withdraw their retirement funds from South Africa.

Under this system, a third of all retirement savings will fall under the savings “pot”, with the remaining two thirds falling under the retirement component. A vested “pot” will consist of all retirement savings prior to the commencement of this system and will be treated the same as they are currently being treated (i.e., separate to the two-pot retirement system).

However, the impact of this system for expatriates and the associated tax implications largely remain unclear at this stage.

A guiding hand in the withdrawal process

Expatriates still in the dark about their tax situation may find themselves facing complexity when attempting to withdraw their retirement funds from South Africa.

A clear and guided approach is essential to help individuals secure the necessary proof and facilitate the seamless remittance of these funds offshore. Understanding the intricacies of the withdrawal process and taxation can make a significant difference in ensuring a smooth transition for expatriates departing South Africa.

Written by Lambert Roberts, Expatriate Tax Team Manager at Tax Consulting SA; and Martin Bezuidenhout, Technical Lead: Expatriate Tax at Tax Consulting SA

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here