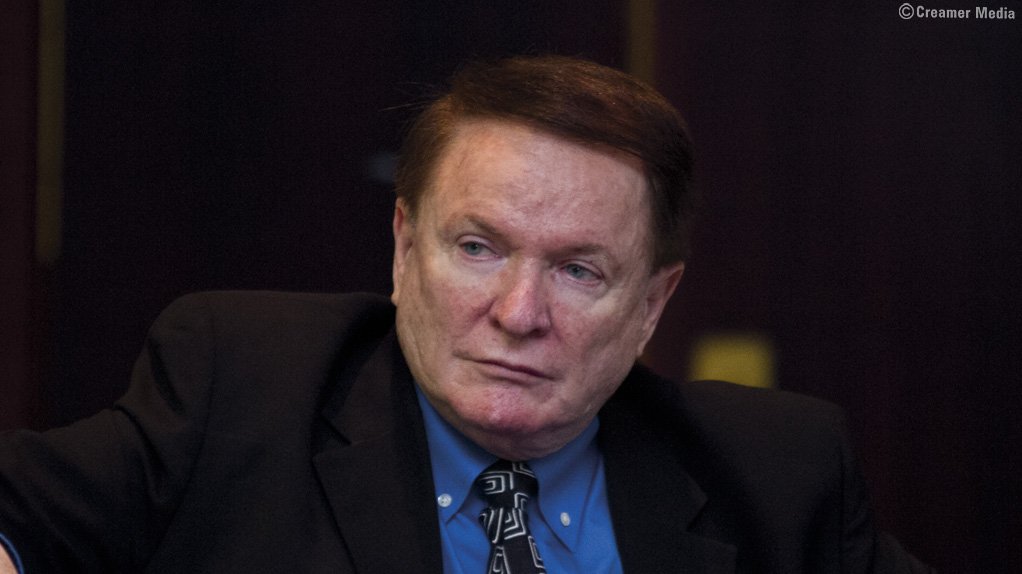

The 'no' outcome in the Greek referendum on the failed financial negotiations with the European Union (EU) will immediately inaugurate a renewed phase of uncertainty in financial markets, until greater clarity emerged on possible fresh negotiations between the Greek government and its EU creditors. The markets had not expected a 'no' vote and would now need to recalibrate their expectations. The risk of intensified market volatility was high. The referendum result had pushed both Greece and the EU into 'uncharted waters' and the outcome was likely to depress markets and the rand for the time being, said Professor Raymond Parsons

In his opening remarks to the MBA Winter Study School of the North-West University Potchefstroom Business School this morning, Professor Raymond Parsons, a professor at the NWU Potchefstroom Business School, said that in the short term much would now depend on whether the European Central Bank would increase its accommodation to the Greek banks this week, failing which the banking system in Greece 'will grind to a halt', and the recreation of a separate Greek currency would become more likely for the country to finance itself. The overarching problem was that the Greek economy was now basically 'both illiquid and insolvent', he said. This needed to be addressed immediately if the 'melt-down' in the Greek economy was to be reversed.

Professor Parsons said that, while there was enough blame to go around for everyone as to what had happened, much now depended on whether fresh negotiations would take place between the Greek government and the EU, and how soon this would happen. Although the Greek government had a stronger political mandate on which to negotiate, it was by no means yet clear to what extent the EU and ECB would be willing to grant Greece terms which were more favourable than those that were ostensibly the subject of the referendum. The EU faced the dilemma of both wanting to enforce the rules of the Eurozone, but not necessarily doing so in ways which would lead to Greece being forced to exit from the euro. Professor Parsons nonetheless believed that the chances of a 'Grexit' had now risen from 20% to 50%.

As the EU was South Africa's largest trading partner and the euro featured the country's 'basket of currencies', SA had a vested interest in the Greek and Eurozone situation being stabilised as soon as possible. The EU/Greek developments were not good news for emerging economies like SA and business in SA should monitor these developments carefully. The rand was likely to weaken in the immediate aftermath of the Greek referendum 'and the future trend of the rand will take its cue from global markets', he said. The current weak state of the SA economy unfortunately made it more vulnerable to the risk of 'shocks' from abroad, whether from the EU or elsewhere, and this emphasised the need to build economic resilience.

'While South Africa is not Greece' said Professor Parsons, there were valuable lessons this country could absorb from the Greek economic experience regarding the importance of avoiding 'debt traps', and not becoming too beholden to tough foreign creditors in the running of an economy. When Finance Minister Nene regularly warned about growing fiscal deficits and the need to curb the escalating public sector wage bill, there should be support for this kind of prudent and timeous fiscal discipline. Sensible fiscal decisions now avoided drastic financial austerity later, and this was a major lesson from the Greek economic dilemmas.

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here