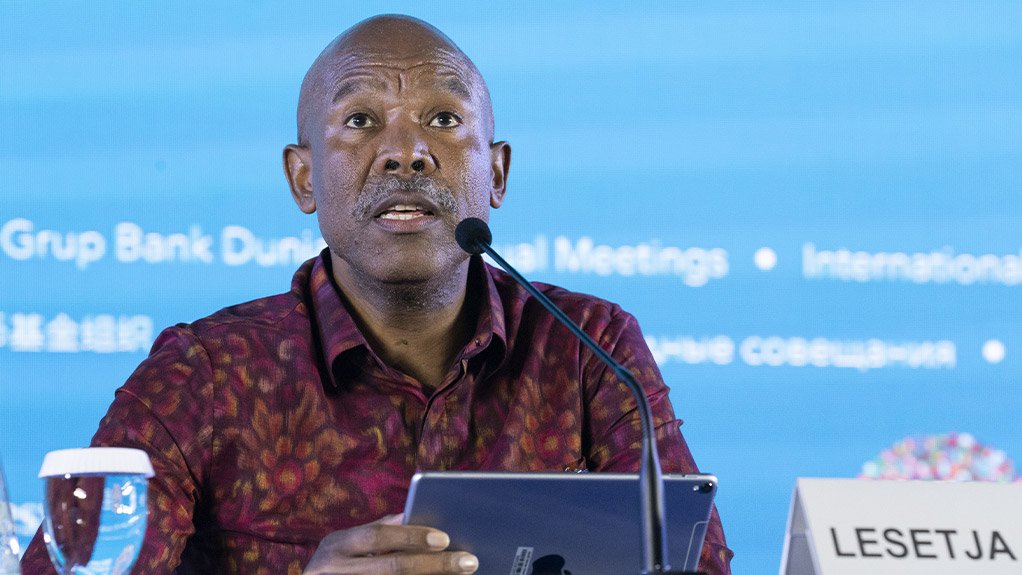

The South African economy needs more of the medicine it received in the late 1990s to achieve sustainable growth and not a boom-bust cycle, says SA Reserve Bank governor Lesetja Kganyago.

Kganyago was an official in the National Treasury when the new democratic government administered its controversial Growth, Employment and Redistribution (GEAR) policy to the economy, cutting spending to rein in debt, liberalising exchange controls, and laying the groundwork for inflation targeting.

GEAR led to SA's most sustained period of economic growth and laid the basis for the country to weather two emerging market crises and the global financial crisis of 2008. But GEAR was politically unpopular with trade unions and the Left, which viewed it as an assault on the working class and on progressive, social democratic policy ideals.

In a speech to the Centre for Education and Economics in Johannesburg on Wednesday evening, Kganyago revived the old debate arguing that the reforms of the late 1990s were not a "conspiracy" or a "form of class warfare" but were practical solutions to real problems. These problems – high debt service costs, which consumed a large part of government resources – and a balance of payments constraint caused by low domestic savings, which made the currency vulnerable – are features that are again present today, the brief respite of high commodity prices notwithstanding.

While growth has been stifled for the past decade by neglected micro-economic policy and the fundamental deterioration of public sector management of the economy due to state capture, microeconomic reform alone will not lead to sustained growth, he argued. That is because the risk is that, again, the fundamental problems encountered in the 1990s will choke off growth.

"If we can start growing again, the old constraints will re-emerge. Like it or not, this means we will need to re-engage with the reform lessons of the 1990s and take a different approach to policy," Kganyago said.

Sustained growth would require a tighter fiscal policy, he argues.

"Once again, we face a situation of rising debt and excessive tax burdens. In the 2000s, we generally had revenue a little under 25% of GDP and spending slightly over 26% of GDP. Now we raise less than 24% of GDP in revenue, despite higher taxes, and then spend about 29% of GDP. This is an unsustainable situation, not least because the efficiency of government spending has been low. Much as I wish we had a strong state that could deliver high-quality public goods at reasonable prices, the facts reflect otherwise. Relative to the 2000s, we have a weaker state, spending a larger share of GDP," he said.

The result has been an economy barely capable of growth of more than 1% and a weak outlook.

"In these circumstances, trying to deal with social needs simply through more spending, more debt and higher tax doesn’t really cure the patient, but rather limits the pain while accepting continued decline. Living standards cannot rise materially without growth.

"The problem goes deeper. If investment did rebound, and government borrowing continues at around current levels, we would then hit a binding balance-of-payments constraint. We have had an investment rate of around 14% of GDP recently, against a savings rate of 15% of GDP. A reasonable investment rate would be over 20% of GDP, and for fast growth probably 30%.

"But given savings levels, this implies borrowing between 5% and 15% of GDP from the world – very large sums. Current account deficits of those magnitudes would simply become too unsustainable, if not impossible, as in the UK currently."

"To achieve balanced growth, rather than just recover a boom-bust cycle, we therefore need better longer-term savings rates. As in the late 1990s, this is going to require fiscal restraint, as a necessary self-control measure, to enable the financing of stronger and more efficient investment," the governor said.

Unfortunately, unlike in the 1990s, when the government could drive through reforms, there is less consensus on how to respond to the current challenges. This is hampered, too, by the memory of GEAR and the lack of consensus on whether the reforms of the late 1990s were helpful or not.

"This weakens our ability to act decisively," he said.

On monetary policy, Kganyago says that the challenge is "to undo the error of 20 years ago, when we gave up on lowering the inflation target".

There is a compelling case to be made for a 3% target, which he said would be in line with SA's peers.

"It would allow for lower interest rates. It would also make inflation less of a concern in the everyday lives of South Africans," he said.

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here