/ MEDIA STATEMENT / The content on this page is not written by Polity.org.za, but is supplied by third parties. This content does not constitute news reporting by Polity.org.za.

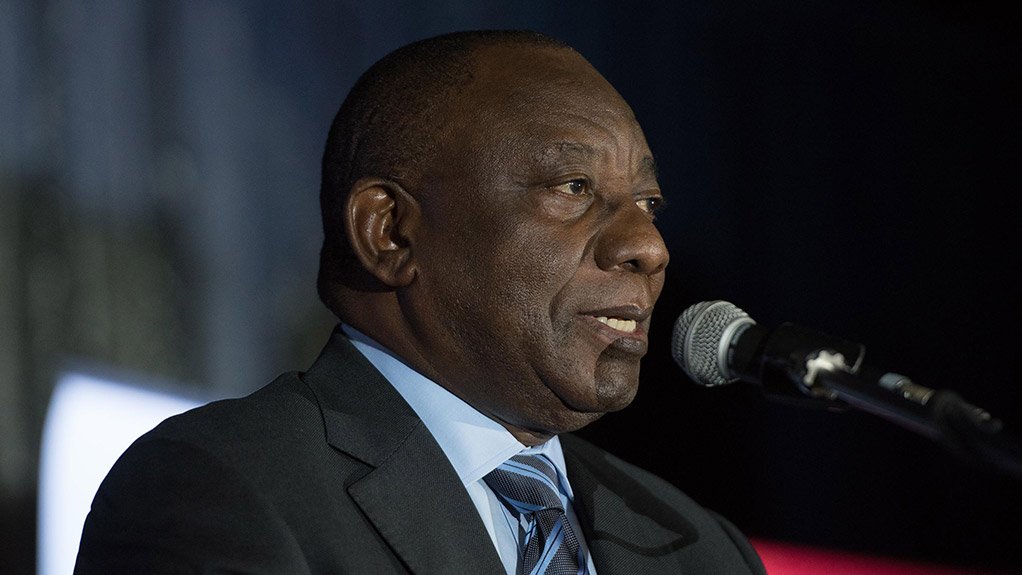

The Democratic Alliance (DA) is dismayed that President Cyril Ramaphosa has signed into law the deeply flawed and possibly unconstitutional National Credit Amendment Bill, drawn up by the Portfolio Committee on Trade and Industry (PCTI) in the fifth Parliament.

The Amendment Bill, will increase the cost of credit for low income earners, weaken the fight against illegal lenders and negatively disrupt the credit market while posing a financial risk to the state, when South African consumers are already under enormous financial strain.

This is why I petitioned the President in April 2019 to give due consideration to the very real issues related to this Act as well as it’s constitutionality.

To make matters worse, the State has no idea what cost to the economy and credit market will be and has been unable to clarify the cost implications for the state in implementing the Bill, including where the R100 million will come from to fund the National Credit Regulator and National Consumer Tribunal to fund their new mandates to process Debt Relief applications.

The DA is concerned that this Act will increase, instead of decrease, the appetite among low income earners to incur more debt with no intention of ever paying it back creating a massive moral hazard, as long as they remained within the legislated threshold of indebtedness.

The Act in its current form fails to make adequate provision to deal with illegal and unregistered rogue lenders who take advantage of consumers who have no recourse or protection of the State. The weakness of this approach is such that an illegal lender only becomes guilty of the offence if reported by consumers and if he or she is located and found guilty. The probability of someone reporting a loan shark is next to zero.

It appears that President Ramaphosa has buckled to pressure from groups like COSATU who have very little regard for the damage this Act will do to the poor.

The DA advocates for credit legislation that protects consumers from debt traps and illegal lending whilst ensuring the sustainability of the credit markets. In contrast, the President has singed into law legislation in an information vacuum which could have disastrous consequences for consumers, the cost of credit and the restriction of credit for low income South African’s.

Issued by The DA

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here