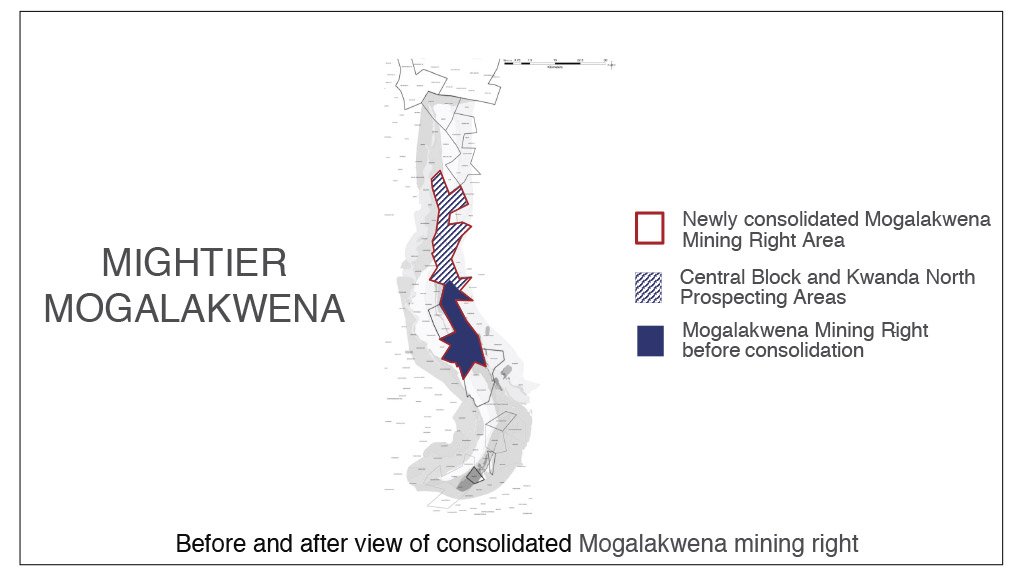

Platinum miner Anglo American Platinum (Amplats) on Tuesday said its subsidiary Rustenburg Platinum Mines (RPM) had completed the buyout of the Kwanda North and Central blocks' prospecting rights from Atlatsa Resources.

The acquisition of the blocks is facilitating the valuable rights consolidation of Amplats' rich Mogalakwena platinum group metals (PGM) mine, where metal credits resulted in platinum being produced at a minus cost of – $292/oz in the six months to June 30.

RPM bought the prospecting rights from Atlatsa for R300-million in cash and will, following implementation of the transaction, write off the R4.6-billion in debt owed to it by Atlatsa, including any current and further debt that may be incurred during the care and maintenance period of Bokoni mine, in Limpopo, until December 21, 2019.

RPM has included the resources specified in the Central Block and Kwanda North prospecting rights into its Mogalakwena mining right.

The administrative process of registration with the Mineral and Petroleum Titles Registration Office will now follow.

The transaction, first announced in December 2018, formed part of a two-phase restructuring plan by Atlatsa. The second phase will involve Atlatsa buying back all common shares held by minority shareholders for R1, or C$0.09, a share, while offering an aggregate nominal cash consideration of R1 a share to RPM.

Once this is complete, Atlatsa will delist from the TSX and the JSE, which is expected to be concluded on September 17.

Mogalakwena, located near the town of Mokopane, in Limpopo, is the largest and richest opencast PGM mine in the world.

A 75 MW photovoltaic solar energy plant is being evaluated for the mechanised Mogalakwena, where green mining is being enhanced and where improved bulk sorting and shovel performance are being advanced.

Amplats last month declared an interim dividend of R3-billion after achieving another strong financial performance in the first half of the year on the back of robust market fundamentals and an 82% surge in earnings before interest, taxes, depreciation and amortisation.

Atlatsa and Amplats' RPM will each retain their holdings in the Bokoni joint venture opencast mine in Polokwane, Limpopo.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here