![]() The management of the COVID-19 pandemic has resulted in tough public policy measures around the globe, including lockdowns aimed at reducing human interaction to a minimum. These measures, which have put a stop to big chunks of economic activity, have come with devastating consequences, forcing business to lay off tens of millions of workers globally.

The management of the COVID-19 pandemic has resulted in tough public policy measures around the globe, including lockdowns aimed at reducing human interaction to a minimum. These measures, which have put a stop to big chunks of economic activity, have come with devastating consequences, forcing business to lay off tens of millions of workers globally.

To mitigate the social and economic impacts, governments have had to dig deep into their finances that in some instances were already under strain. These are over and above the resources that governments need to pump into their health systems as they battle the pandemic. This additional expenditure comes at a time when the shutdown of economic activity has reduced tax collection, placing further strain on the public purse.

The Conversation has brought together analyses of these issues by its network of experts. In this round up we pulled together some of the articles from the week that was. They cover national budgets in the time of COVID-19, how remote working is worsening inequality, the pandemic’s after affects on inflation, rising unemployment, and the likelihood of a higher debt burden on future generations.

This is our weekly round-up of expert information about the coronavirus.

The Conversation, a not-for-profit group, works with a wide range of academics across its global network. Together we produce evidence-based analysis and insights. The articles are free to read – there is no paywall – and to republish. Keep up to date with the latest research by reading our free newsletter .

What various countries are doing

Governments have two options to finance additional expenditures: higher taxes and raising more debt.

-

Indonesia has decided to issue government bonds to finance a stimulus package to counter the impacts of COVID-19. Nurhastuty K. Wardhani explains that the long-term nature of the bond and its denomination in US dollars will most likely be a burden on future generations.

-

Argentina is seeking ways to tax its way out of the current economic crisis induced by COVID-19. Alejandro Milcíades Peña and Matt Barlow explain why this is risky for a country that already has very high tax rates.

-

New Zealand should unleash aggressive but well-targeted spending, says Ilan Noy. Without it, the burden of an L-shaped economic trajectory will be far greater on future generations than any debt governments might take on now to develop a vaccine or keep businesses afloat and people on payrolls. Norman Gemmell outlines what the country’s forthcoming budget should look like as the country prepares to come out of its COVID-19 lockdown.

-

A number of African countries face strained public finances, some already struggling to repay their debt. In response, there have been growing calls for debt relief. However, Rodrigo Olivares-Caminal argues that any proposed moratorium must involve lenders and investors to prevent unintended consequences that could be costly for Africa.

-

Canada is forecasting a twelve-fold increase in its budget deficit this financial year, driven by the sharp drop in forecasted tax collections and the government’s extraordinary spending measures to support the economy and manage the pandemic. However, as Patrck Lebland says, this may not result in higher taxes.

-

US unemployment shot up from 4.4% in March to 14.7% in April, but Jay L. Zagorsky says unemployment is not likely to reach 25%, the highest level reached during the 1933 depression. In his view, the crisis will be short-lived and the US economy will rebound when people resume their economic activities.

-

Australia‘s Reserve Bank has forecast overly optimistic economic growth and employment (one in 13 people in Australia will lose their jobs) for the next two years, according to Peter Martin. Drawing on what happened after the global financial crisis in 2008, he sees a recovery that looks more like a flat-bottomed boat.

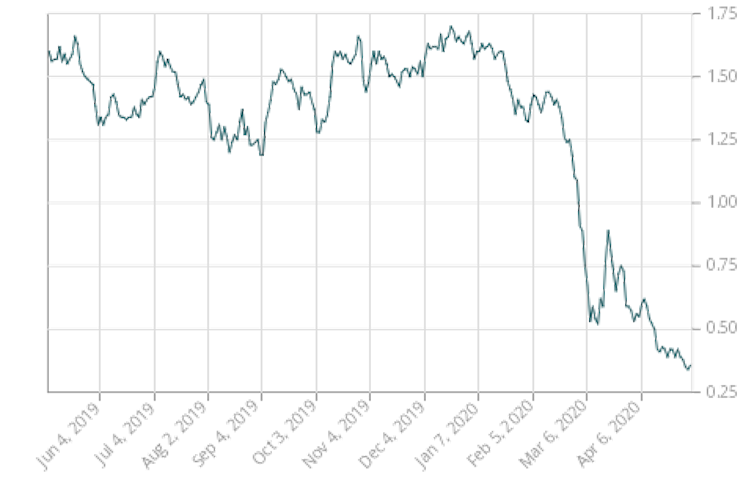

Meanwhile, Alan Shipman cautions about the dangers of a further decline on consumer price inflation. When consumers sense that prices are going to continue falling, they put off expenditure on non-essential purchases, hoping to pick them up later at an even lower price. Such behaviour obviously leads to a decline in consumer spending, one of the major drivers of economic activity.

Workplace and inequality

-

The office will change beyond the pandemic. Dave Cook outlines the five trends that will shape the workplace of the future.

-

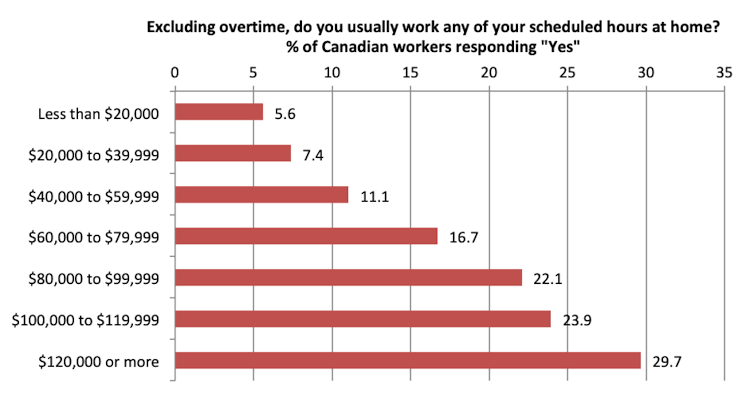

Remote work can be a source of socioeconomic inequality, warn Ugo Lachapelle and Georges A. Tanguay. While the measure is aimed at slowing down the spread of the pandemic, the researchers analysed 2015 Canadian General Social Survey (GSS) data to show that the number of telecommuters increases with personal income. Jobs with a large share of low-income workers generally have few telecommuters and lose out on its benefits.

Get the latest news and advice on COVID-19, direct from the experts in your inbox. Join hundreds of thousands who trust experts by subscribing to our newsletter.

Written by Jabulani Sikhakhane, Deputy Editor and Business & Economy Editor, The Conversation

This article is republished from The Conversation under a Creative Commons license. Read the original article.