JOHANNESBURG (miningweekly.com) – The regulatory uncertainties and inability of the industry to transparently, quickly and efficiently apply for mining and prospecting rights in a corruption-free manner has had severe investment consequences, Minerals Council South Africa states in its Facts & Figures Pocketbook 2022.

This is glaringly evident in exploration, which, the Minerals Council adds, has virtually ground to a halt.

In 2022, the mining sector spent a mere 9% of what it did during the commodity price peaks of 1990 and 2006 – and then overwhelmingly on brownfields exploration in existing licence areas and minutely in new unexplored greenfields areas.

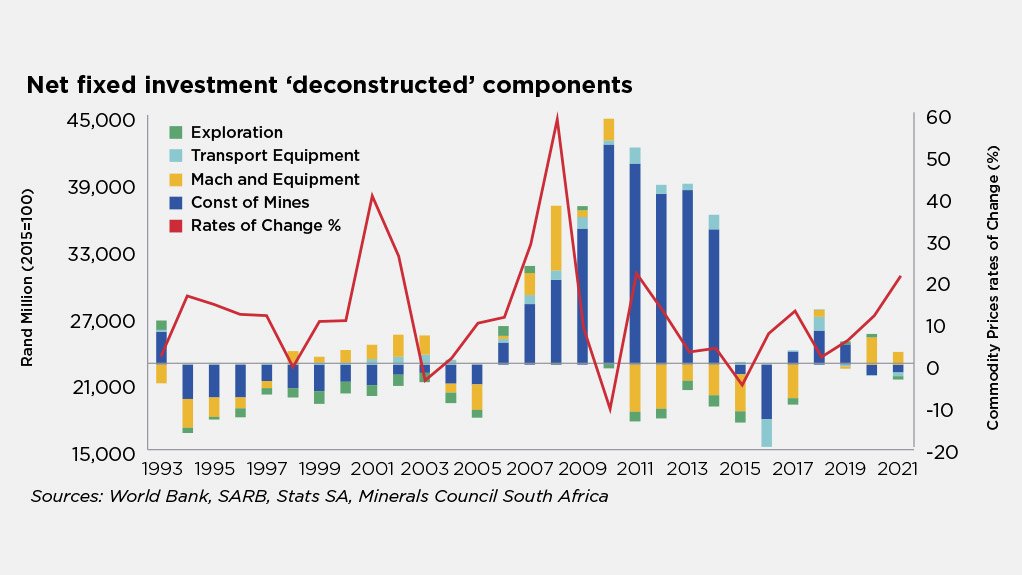

Under a gross fixed capital formation headline, the council points out that higher commodity prices have not resulted in higher fixed investment in mining, owing to the structural domestic constraints.

Minerals Council chief economist Henk Langenhoven and his team provide crucial insight into what mining’s numbers mean for the highly significant role that mining plays in South Africa.

While the positive impact of rising commodity prices continues to benefit mining financially, the longer-term production trend is struggling to break out of its low trajectory.

In spite of continual warning headlines and pleas for public sector collaboration, 2022 export volumes were 20% lower that pre-lockdown 2019 volumes owing to energy and rail disruption.

In fact, rail, harbour and electricity constrained export growth to such a degree that monthly volumes were at 2017 levels; only in 2019 were 15-million tons exported monthly but volumes have again dropped below that level.

This despite commodity prices in rands improving from 24% in 2020 to 19% in 2021 and then a further 70% up to December 2022.

But fixed investment stagnated last year, amid self-generation electricity projects being ‘stay in business investment’, and not investments in mining capacity expansion.

Meanwhile, mining input costs have been rising at over 15% on average during 2022, which will in time put pressure on employment numbers of 475 561.

Higher commodity prices are saving the day by lifting exports by 5% to R900-billion in 2022, when gross domestic product for mining declined 6%.

The 77 members of the Minerals Council represent 90% of South Africa’s mining production, with the financial contribution from this country’s platinum group metals mining companies leading the other ten commodity groups as a generator of revenue.

The economic contribution of the mining industry to the fiscus remains a key source of revenue for the South African government at a time when State-supplied electricity and transport logistics are dealing with crippling constraints and are negatively affecting the economy.

South African mining remained a trillion rand industry for the second year running when measured in production value, despite the headwinds of 2022. The value of production was R1.18-trillion.

Its direct contribution to South Africa’s gross domestic product (GDP) was R493.8-billion, making up 7.53% of the total GDP contribution.

“During 2023, we shall continue working closely with our business peers and other stakeholders to ensure there are sustainable and pragmatic solutions to the energy and transport constraints as well as progress addressing the deteriorating crime and security environment for not only the mining industry but the entire economy.

“If these blockages are resolved, with the inclusion of the private sector, the mining industry’s role as a key contributor to the wellbeing of the South African economy will be fully unlocked to the benefit of all citizens,” says outgoing Minerals Council CEO Roger Baxter in the pocketbook release to Mining Weekly.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here