Honourable Chairperson,

I present the National Treasury’s Budget Vote for the consideration by the House. It is a vote which builds on the enduring achievements of the first 20 years of our democratic dispensation but also lays the building blocks of faster progress over the decades ahead.

The National Development Plan (NDP) reminds us, and quiet rightly so, that our development objectives cannot be achieved in a few years. CNN anchor Richard Quest could not have put it better when he said on Radio 702 in May this year that 20 years is a pin-prick on the skin of democracy. But that is no comfort to fellow South Africans who are unemployed, who are poor and live in less than ideal conditions.

To those fellow South Africans we can only offer the comfort that while many of the initiatives will take time to be felt in their lives, there are immediate things that can be done to alleviate their plight.

As we knuckle down to implement the NDP we should also remember that precisely because national development is a long-term project it must be financed sustainably. Our pressures today should not, for example, blind us to the burden our decisions may impose on children born this year, in 2024 or 2034.

Honourable members, it is to these issues – a sustainable fiscus and a stable macroeconomic environment – that this Budget Vote talks to.

Before I walk you through some of the details of the Vote, allow me to set out the economic context in which South Africa finds itself today. While the global economic environment is showing signs of improvement, it remains below optimal levels. South Africa is not an island, cut-off from the rest of the global economy. So, our economy is performing below its potential, and certainly way below the level of growth that is required to deal with the country’s triple challenges of unemployment, poverty and inequality.

However, the biggest constraints to a faster rate of growth are domestic factors, in other words things that are within our powers to fix. The NDP places us in a stronger position to address these, and so does the announcement in June by President Zuma of the various measures that have to be taken to jump-start the economy.

Over the period ahead, new power plants and transport infrastructure will lift constraints to output, a stronger global recovery will support exports, and growth in Sub-Saharan Africa will promote expanded trade and investment. But to grow the economy at a faster rate that can rapidly reduce unemployment and poverty requires bold decisions to increase competitiveness and innovation in a fast-changing world.

Fiscal outlook

South Africa’s budget supports the implementation of the National Development Plan. Government has ensured that the priority programmes identified in the manifesto of the African National Congress, which are now being translated into a medium term strategic plan, are funded.

Nevertheless economic weakness and the rising burden of public debt reinforce the importance of ensuring the sustainability of fiscal policy over the period ahead. The changing global economic climate is providing new challenges to the fiscal outlook. When the economy was faced with a recession in 2009, prudent fiscal management in preceding years meant that we were better able to use our fiscal space to respond to the crisis. Low international interest rates helped government to finance its borrowing requirement, inflation was moderate, and high commodity prices buoyed our tax revenues.

Now we are entering a new environment – rising global interest rates have increased the cost of servicing our debt, commodity prices have declined, and the depreciation of the rand has pushed up inflation. The fiscal space built up in the 2000s has diminished. The period ahead will not be easy. To ensure that the fiscus remains sustainable, the three principles that are the backbone of our fiscal stance remain in place: counter cyclicality, debt sustainability and intergenerational fairness.

Over the next three years government will stabilise the growth of public debt, and then begin to rebuild fiscal space. This will be achieved by remaining within the expenditure limits we have set in the medium term framework. This ceiling means that expenditure will continue to grow and the real value of our social spending will be maintained. But the fiscal limits will be far stronger, and the need to ensure value for money and effective allocation of resources even more paramount.

Despite the contained growth in expenditure, government’s budget deficit has remained elevated. In aggregate, the final outcome of tax revenue for the 2013/14 fiscal year was R899.8 billion, in line with the target we set in the Budget. However, over the last few years weaker economic growth has meant lower than anticipated revenue.

The situation is expected to improve over the period ahead, with the budget deficit projected to narrow from 4.0 per cent in 2014/15 to 2.8 per cent of GDP in 2016/17. If growth outcomes continue to disappoint, achieving this objective will be much more difficult. But government remains committed to the sustainability to the fiscus, and if necessary further measures will be taken to achieve our objectives.

Asset and liability management

Prior to the global crisis the stock of public debt stood at R525 billion. It has now risen to R1,590 billion. By the end of the current MTEF, we expect the net debt of government to reach more than R2 trillion.

Government continues to manage this portfolio in a prudent and far sighted manner. Recently, we approved strategic benchmarks that set guidelines for exposure to various categories of debt portfolio risks. These benchmarks are consistent with government’s objectives to raise cash in a cost effective manner, while managing risks prudently.

The country's credit rating is currently under pressure due to a combination of domestic and global challenges. There is very little we can do about the global environment, but there is a lot we can do about our domestic challenges. So, let's demonstrate a greater sense of urgency in the implementation of our policies, acting with speed to remove constraints to economic growth and therefore job creation.

We will act decisively to avoid further downgrades, as these will result in a significantly higher cost of borrowing, both for government and state owned companies, and the cost of financing infrastructure programmes will increase.

In support of the infrastructure roll out by state owned entities, government exposure to public entities through debt guarantees has increased to R209.2 billion in 2013/14, from R180.2 billion in 2012/13. Eskom making up 58.5 per cent of the total government guarantee portfolio. If we add debt provisions and contingent liabilities to our stock of debt, government’s liabilities are forecast to peak at 57.1 per cent of GDP in 2015/16.

In the current financial year, the government will recapitalise the Land Bank with R500 million and DBSA with R2.5 billion. The recapitalisation of the Land Bank forms part of the 2009 recapitalisation programme of R3.5 billion meant to increase the Land Bank’s focus on developing farmers as well as to address its declining capital adequacy ratio. The recapitalisation of the DBSA is mainly to enhance the DBSA’s capital base and to allow the DBSA to expand its lending to local government and address its broader mandate.

During the 2013 MTEF, Cabinet approved an amount of R481 million to the SA Post Office, earmarked for the corporatisation costs of the Post bank subject to certain conditions, including the provision of a comprehensive project plan.

Intergovernmental developments

All economic activity is local. It happens in factories and other centres of commerce that are based on municipal soil. Workers and consumers also live and work in areas that fall under a municipality.

So, well-functioning municipalities are critical to accelerating national economic growth. Improved service delivery at local level is a critical government objective. To this end, the local share continues to be the fastest growth element in the division of revenue. Nevertheless, it is common knowledge that municipalities face challenges in delivering public services to our people.

It has been suggested that the local government fiscal framework is not responding sufficiently to this objective. Given these concerns, National Treasury in collaboration with sector departments and stakeholders, is reviewing the local government fiscal framework focusing on both national transfers to municipalities and the revenue municipalities generate on their own. The focus over the next three years will be on reviewing the local government infrastructure grants system.

As our cities grow, our large metropolitan municipalities can no longer focus only on providing basic services and housing, but must also facilitate private sector investment and the creation of jobs. Urban infrastructure investment is the key to unlocking the potential of our cities. Already, government has invested massively in a new generation of integrated housing programmes and public transport systems, such as Rea Vaya and others.

The acceleration of these programmes requires metropolitan municipalities to both more carefully select investment programmes and make a far greater financial contribution to their implementation.

All metros have already developed urban investment strategies and identified catalytic projects that will assist to stimulate growth but at the same time transform the spatial socio-economic structure inherited from the apartheid era. Government is in discussion with the DBSA to facilitate the provision of reasonably priced financing for cities that have prepared bankable projects with private sector participation.

Financial management interventions

As the NDP points out, the key to an effective and a capable state is having employees at all levels who not only have the authority but the experience and competence to do their jobs. In this regard, financial management skills are critical. National Treasury is implementing a number of initiatives to address shortage of financial management skills. We will implement a Capacity Development Strategy to address financial management capacity constraints in the public sector.

In collaboration with provincial treasuries, National Treasury will also roll out a municipal support and capacity programme to address the challenges faced by municipalities within the entire financial management cycle.

During this year, the Office of the Accountant General will put forward plans to strengthen the regulatory environment in the audit and accounting industry. This will be done by taking into account the recommendations of the Report on the Observance of Standards and Codes (ROSC) done by the World Bank.

Savings and retirement reform

To encourage South Africans to save, especially for their retirement, National Treasury has proposed a number of reforms. I will continue to engage with the various unions and stakeholders to further explain what we are trying to do as Government in enabling a retirement system which offers good value and protection for retirement savings. It is necessary to stress once more that workers have nothing to fear from these reforms. Their money is safe. These reforms are not about nationalising of their retirement savings. Nor are they about grabbing workers’ money to fund Government projects.

Fighting corruption

Honourable members, we will continue with our efforts to reform procurement with a view of minimising corruption and make it easier to detect when it has occurred. We will also render the system of supply-chain management in government more accessible and innovative. The Chief Procurement Office will, among many other projects, enhance the existing system of price referencing, in order to set fair value prices for certain goods and services. It will also pilot procurement transformation programmes in the Departments of Health and Public Works, nationally and in the Provinces.

We will also run pilots on centralising aspects of big tenders in line with the manifesto of the ruling party.

In conclusion, honorable members, let me borrow the words of Nelson Mandela who said in his last State of the Nation Address (SONA) in 1999: “The foundation has been laid – the building is in progress.”

So let us all – government, private sector, labour and civil society at large - roll up our sleeves in partnerships for change and build the country of our dreams.

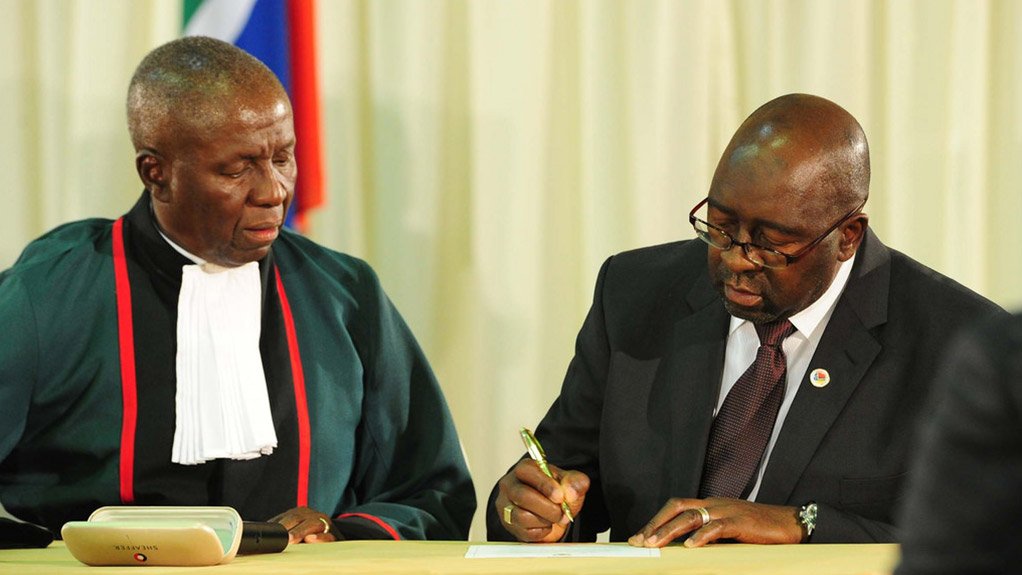

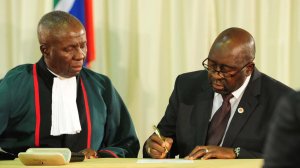

On that note, honourable chairperson, I table Budget Vote 10 for consideration by the House.

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here