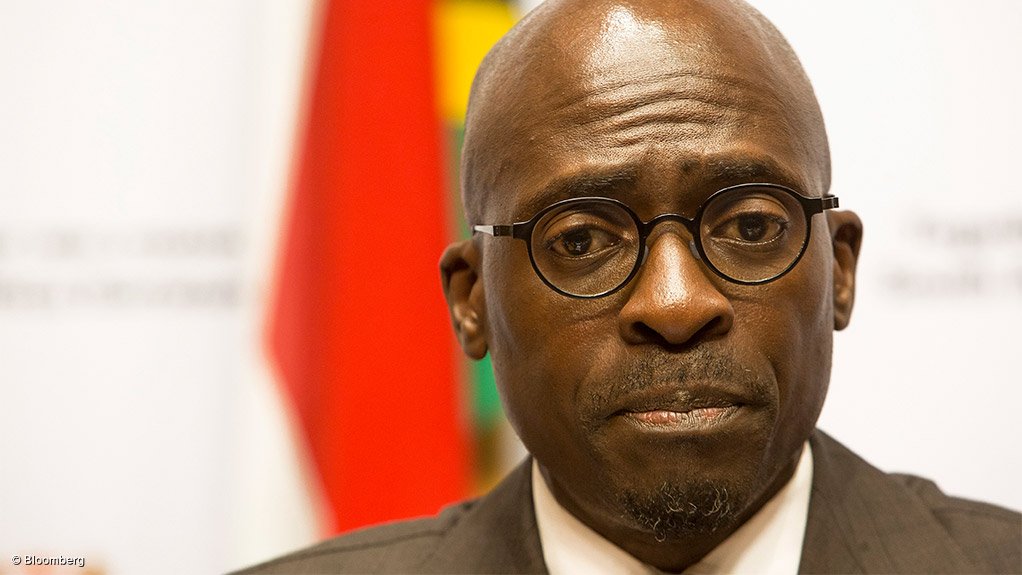

Finance Minister Malusi Gigaba signed and gazetted various provisions of the Financial Intelligence Centre (FIC) Amendment Act, National Treasury said on Tuesday.

“Commenting on the signing of the Act, Minister Gigaba said it was critical for government to accelerate the implementation of the Act as it demonstrated government’s commitment to the fight against corruption, money laundering and illicit flows. The Minister added that although the signing of the Act was a big step forward, more work still needed to be done,” Treasury said.

“The key objective of this law is to improve the protection of the the integrity of South Africa’s financial system and strengthen its ability to prevent and punish financial crimes like money laundering, illicit capital flows, tax evasion, corruption and bribery, and financing of terrorism.”

President Jacob Zuma signed the FIC Amendment Act into law on April 26 and gazetted the Act on May 2, but the determination of the commencement date was left to Gigaba, Treasury said in a statement.

According to Treasury, the FIC Amendment Act achieves the above objective by placing the risk‐based approach at the centre of South Africa’s Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regime.

The Act recognises that the risk of money laundering and terrorist financing can vary by individual, business sector and within sectors.

The implementation of different provisions of the FIC Amendment Act would start on June 13, 2017, and October 2, 2017. Dates to be determined after October 2, but not later than the end of 2018, Treasury said.

“These provisions do not require changes to existing regulations, exemptions or internal systems of institutions to enable compliance with the FIC Act. The provisions deal mainly with information sharing, consultation arrangements, constitutional concerns relating to inspection powers, and improved functioning of the FIC Act Appeal Board,” Treasury said.

“The second set of provisions will commence on 2 October 2017. These provisions, which give effect to the above-mentioned new concepts and approaches, will require changes to existing regulations and exemptions under the FIC Act, as well as staff training and major changes to systems by supervisors, the Office of the Chief Procurement Officer, and accountable institutions.

“The accelerated implementation of the FIC Amendment Act demonstrates Government’s commitment to fight corruption, money laundering and illicit financial flows.”

Treasury said that the commencement of the FIC Amendment Act confirms South Africa’s commitment to improve compliance with the Financial Action Task Force international standards “in respect of measures on foreign Politically Exposed Persons, Beneficial Owners and record keeping”.

Treasury said that the commencement and operationalisation dates of the two remaining set of provisions in the FIC Amendment Act, namely sections 26A to 26C dealing with the freezing of assets in terms of the UN Security Council Resolutions on targeted financial sanctions, and Schedule 3A dealing with the setting of a monetary value threshold for companies doing business with the State, will be determined after October 2017.

“The delay on sections 26A to 26C is to to enable consultations within Government, and allow for internal systems development,” it said.

“One of the new features that will be introduced by the Amendment Act is a requirement for institutions to determine whether there are specific money laundering or terrorist financing risks associated with relationships with prominent persons in companies doing business of a certain value with the State.”

This provision, which relates to Schedule 3A, will commence on 2 October 2017, but will “require operationalising later by notice, once a monetary value threshold has been finalised and the State is able to generate such a database or capability”.

Treasury said that it was working with the Chief Procurement Office in this regard.

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here